Elkhorn Medicare Solutions is your LOCAL resource for your Medicare plan needs.

Our goal is to provide the information, guidance, and advice so you choose the right Medicare plan that fits you and your lifestyle

Five Steps of Enrollment

1) Understand…

Medicare has many enrollment periods and timelines built around them. Initial Enrollment Period, Special Enrollment Period, Annual Election Period, and others. Knowing what you can and cannot do in each and the timelines is critical in avoiding possible late enrollment penalties

2) Research….

There are 2 main paths you can take to plug the holes left by Original Medicare. Medicare Supplement plans and Medicare Advantage plans act very differently. Knowing the differences will make your Medicare decisions easier

3) Enroll in Medicare...

Some people will be enrolled automatically into Medicare Parts A & B. Others will need to contact Medicare to initiate that process. What group do you fall in? Without being enrolled in Medicare, you cannot enroll into Supplement plans or Advantage plans. There is a lag time from applying to being enrolled. Don’t be late or you could be without coverage

4) Select & Enroll…

Upon receiving your Medicare ID card with Parts A & B active, you now can enroll into the Supplement, Advantage, or Part D plan that fits your needs and lifestyle. Enrollment in Medicare is required before enrolling in your plan

5) Review…

You cannot just ignore your plan choices after they are made. Advantage plans and Part D plans change every year. Review your coverage annually with us to be certain you have the plan that best fits your needs and expectations

Why Elkhorn Medicare Solutions

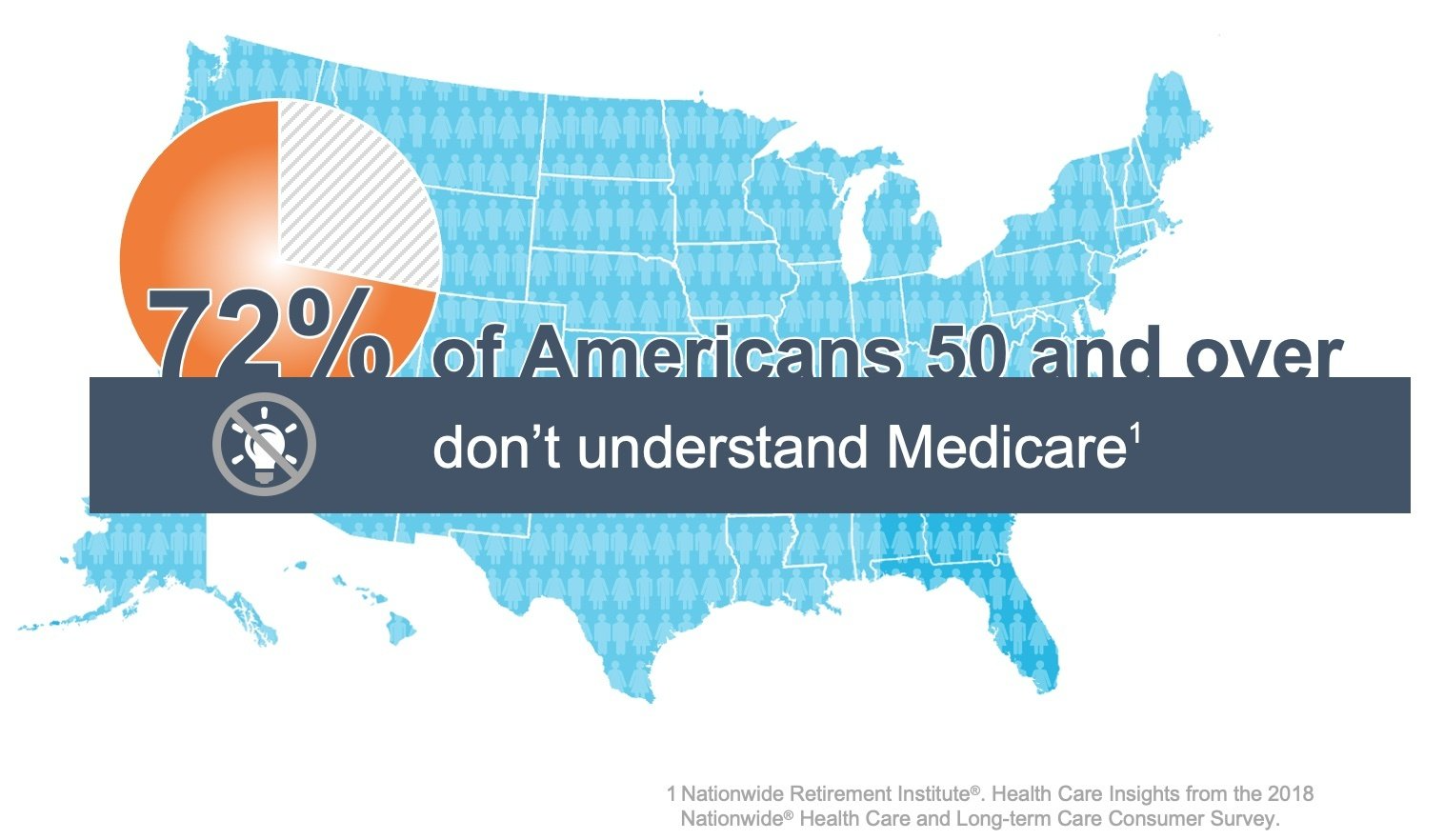

With so many plans available, a seemingly never-ending mailbox barrage, and TV commercials that are confusing, how do you know what plan fits your needs?

- We get to know you

- We take the time to understand your needs

- We speak in plain language

- We make the process simple

- We are local and available

Testimonials

Jim sat down with my wife and I and explained all options and answered all of our questions about Medicare that we needed to make a good decision. Before I retired, I was an insurance agent so I wanted the same type of service I gave to my clients. Jim gave us that! I would recommend Jim to anyone looking for their Medicare insurance.

Mike, Lake Geneva

I'm glad my friend recommended Jim as my health insurance broker for his expertise and advice in helping me navigate the complexities of Medicare insurance. He is knowledgeable and a great communicator in educating his clients about their health care needs. I am so glad he is my Medicare plan agent.

Susan, Elkhorn

Jim has been and continues to be a tremendous help to me as I navigate the world of medicare supplemental insurance and part D drug plans. My experience with Jim has been so successful and positive that I continue to recommend friends and family to him as they move into the world of medicare supplemental insurance and part D drug insurance plans. He is not a one and done agent, he will be there for you for any questions or needs you might have regarding your supplemental insurance or your Part D drug plan.

Carole, Fontana

Jim asked the right questions and, most importantly, listened carefully to my “wants and needs” as I move forward through life’s stages and milestones. - Having just turned 65, the somewhat confusing task of choosing the right Medicare plan was made easy as Jim explained all options clearly and with kind patience!